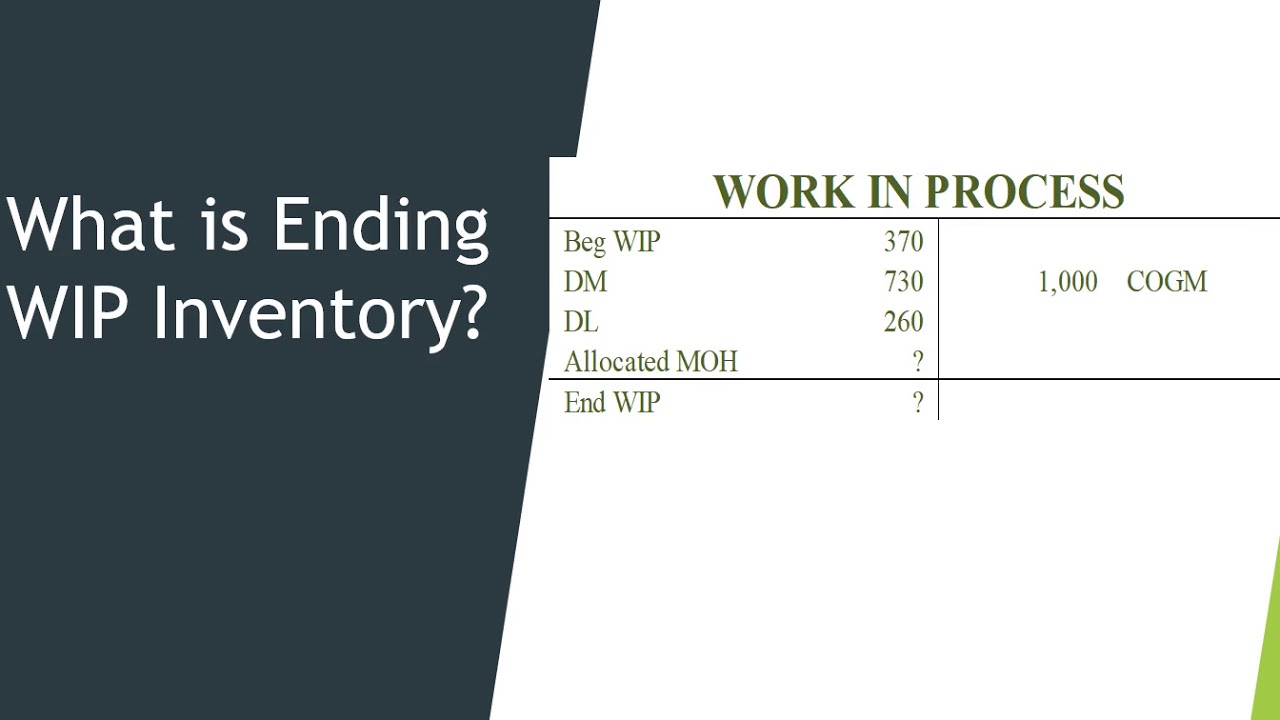

work in process formula

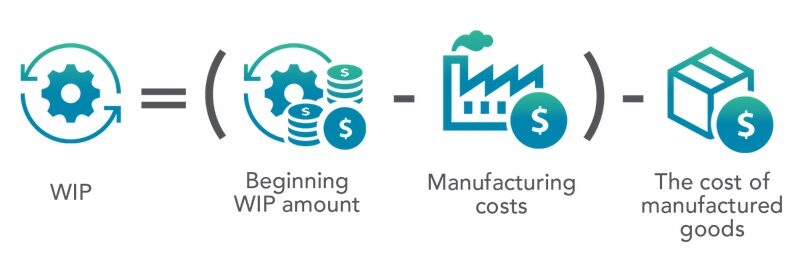

The formula is as follows. Beginning WIP Inventory Production Costs Finished Goods Ending WIP Inventory.

Work In Process Wip Investinganswers

The following article will guide you about how to calculate opening and closing work-in-progress.

. Ending work-in-process beginning work-in-process all manufacturing costs during the period - cost of goods manufactured during the period How to Calculate Work-in-Process Inventory. 10000 300000 250000 60000. A work-in-progress WIP is the cost of unfinished goods in the manufacturing process including labor raw materials and overhead.

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP. Fortunately you can use the work-in-process formula to determine an accurate estimate. Your WIP inventory formula would look like this.

As raw materials and components are consumed they. Work in process inventory calculations should refer to the past quarter month or year. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP.

The cost of work-in-process typically includes all of the raw material cost related to the final product since raw materials are usually added at the beginning of the conversion. Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory. Once you have all three of these variables the formula for calculating WIP inventory is.

Work in process inventory 60000. WIP or Work in Progress is a part of a companys overall inventory that has begun being processed but is not yet finished. Work in Process Inventory Formula Therefore the formula from which a business can calculate their COGM using work in process inventory costs can be displayed like this.

You might have always been thinking about how to find work in process inventory. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. Formulas to Calculate Work in Process.

The more WIP inventory being used in the production process the higher material and labor costs will be. Fortunately you can use the work-in-process formula to determine an accurate estimate. Adding the totals of these categories.

This can have a direct impact on the total cost of those manufactured. WIPs are considered to be a current. The WIP figure indicates your company has 60000.

To calculate the WIP inventory ie work in process inventory you need to use the following work. Accounting with Opening and Closing Work-in-Progress-FIFO Method. WIP Inventory amount Beginning Work in Process Inventory.

Solved B Calculate Total Amount Of Combined Cost Incurred In 2017 2016 Course Hero

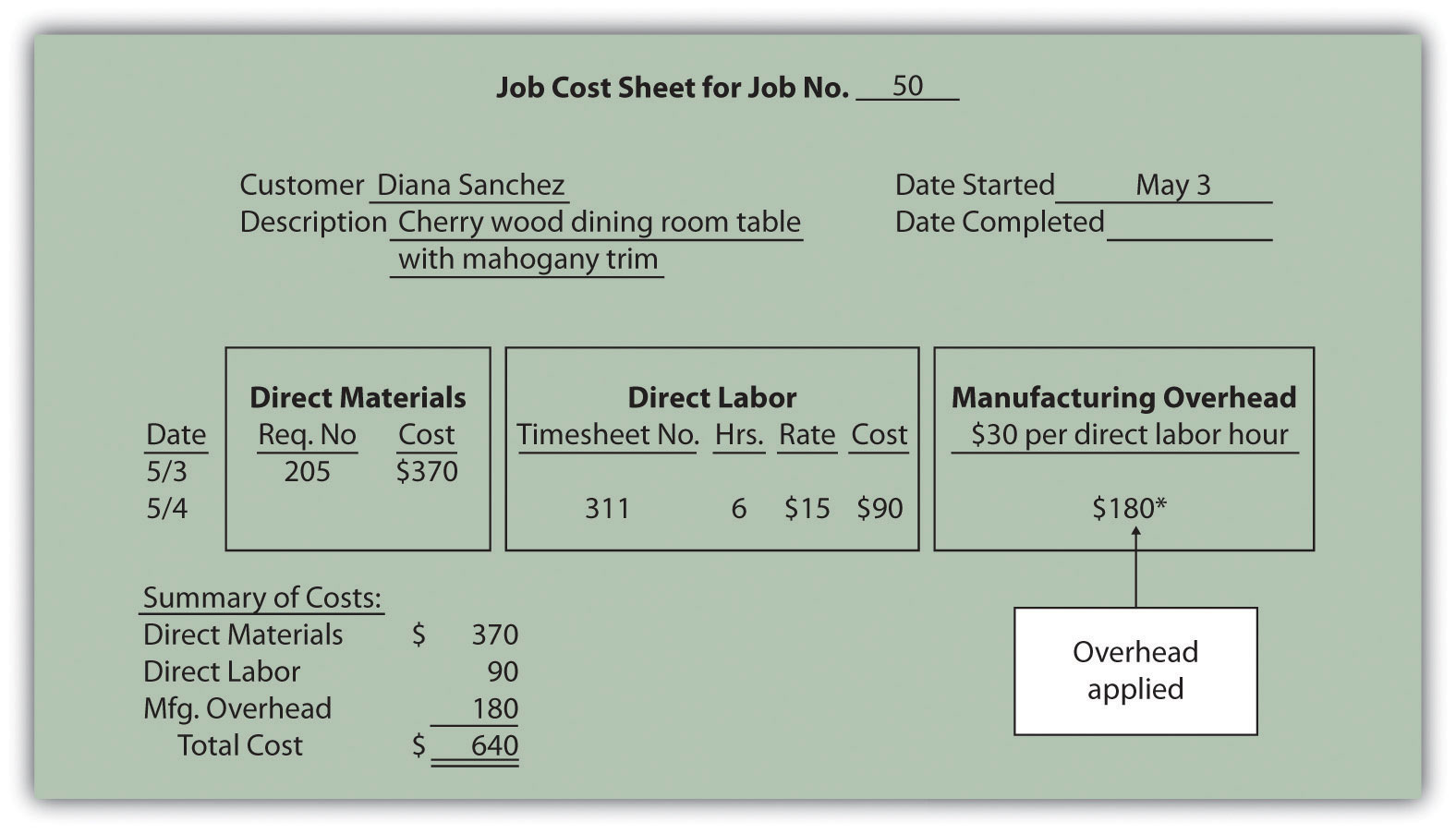

Assigning Manufacturing Overhead Costs To Jobs

Solved The Following Information Concerning Inventories For Neiman Company Is Available Beginning Work In Process Inventory 60 000 Ending Course Hero

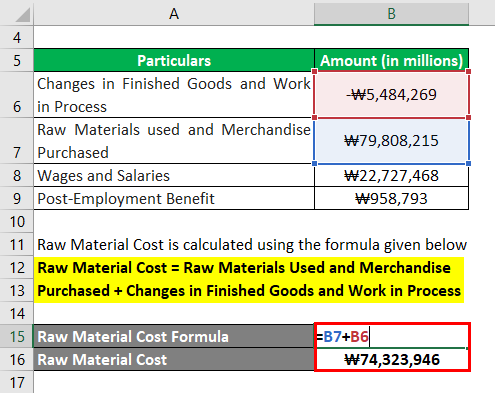

Prime Cost Formula Calculator Examples With Excel Template

Process Costing Cost Of Ending Wip And Units T O Youtube

Solved Further Info Is In The Attached Images For The Excel Part Of The Course Hero

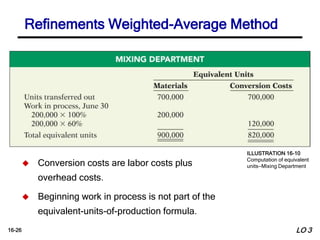

Managerial Accounting Weygandt Kieso Kimmel Ppt Download

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Work In Process Inventory Formula Wip Inventory Definition

Work In Process Ledger Account And Applying Manufacturing Overhead Youtube

Management Accounting Ppt Download

Work In Progress Wip Definition With Examples

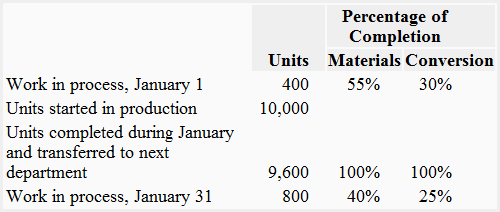

Equivalent Units Of Production Fifo Method Explanation Formula And Example Accounting For Management

How To Calculate Manufacturing Work In Progress Wip Solutionbuggy

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus

Solved Calculate The Ending Work In Process Inventory Chegg Com